How to Add Child Allowance

This area will show how you can set your Child Allowance Band

Some households have higher income than your school's bursary criteria but they have a lot of children to spend the money on. When a student is applying for a bursary, they can add dependents (eg other children living in the household) which will deduct an amount from their total household income.

This way, the student can be eligible for the bursary or can be allocated to a higher band.

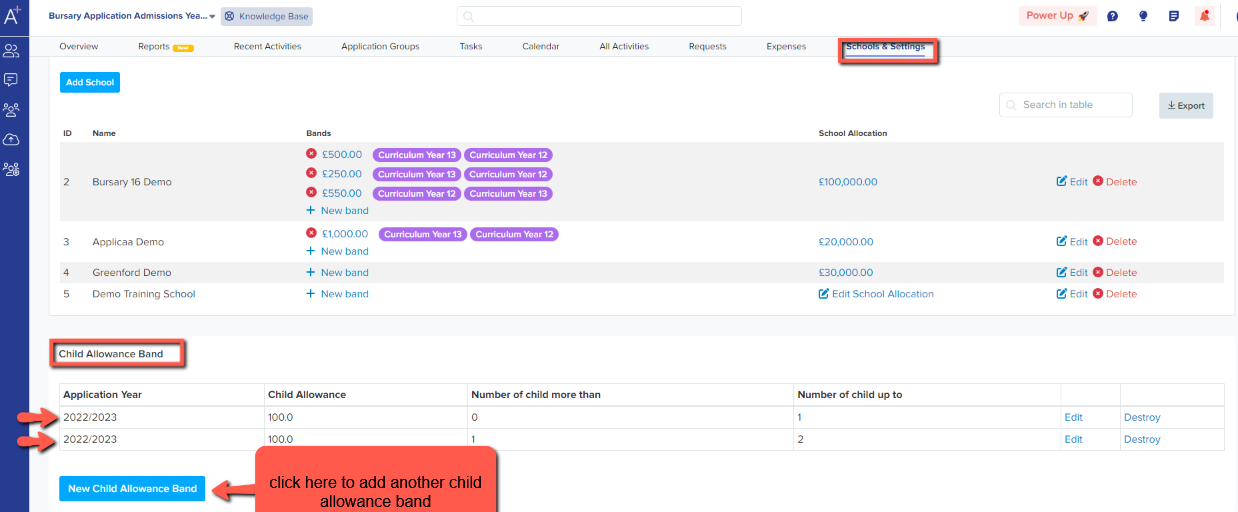

To use the Child Allowance Band, go to Schools & Settings and scroll down to "Child Allowance Band". You will see some sample bands which you can edit or delete so you can add your own.

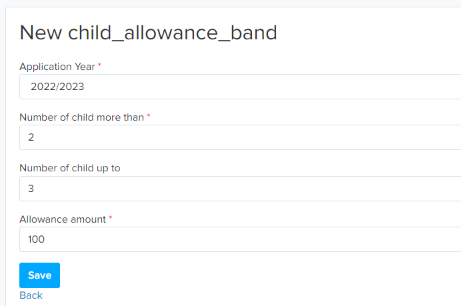

Clicking on 'New Child Allowance Band' or edit will show you this page where you can fill in your criteria.

Enter the application year where this band will apply (typically Years 12 & 13)

Then enter the number of children from least to maximum (Number of child more than & Number of child up to)

Then lastly, put the allowance to be deducted if they add a dependent.

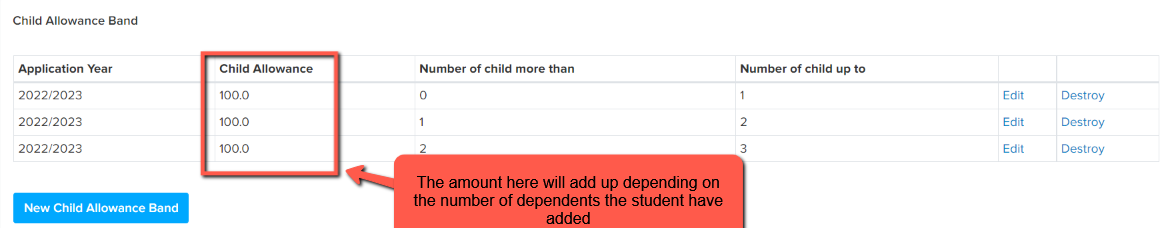

The child allowance bands work in a cumulative manner - for example, 3 children would generate a £300 deduction from the total household income, in the example below.

The amounts to be deducted interact with one another, rather than being standalone - the Child Allowance amount is per dependent child. So, whilst each row says £100 (in the example below), that means £100 per child.

So on this sample, the amounts showing below will add up to £100 if the student has added 1 dependent, £200 if the student has added 2 dependents or it will add up to £300 if the student has added 3 dependents.